Local graduates to save hundreds in student debt

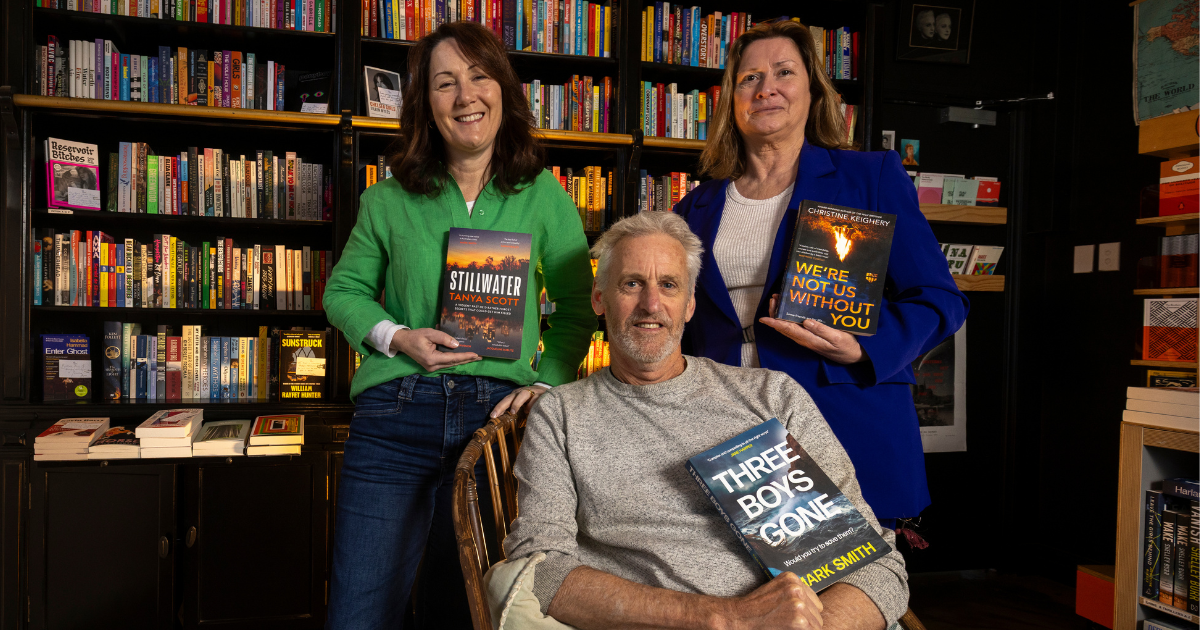

Corangamite federal member Libby Coker (second from left) and Education Minister Jason Clare (far right) visited Deakin University's Waurn Ponds campus recently to chat with students and staff from the education and engineering faculties about debt relief. Photo: SUPPLIED

AN ESTIMATED 38,000 student debts across the Surf Coast and Greater Geelong region will be reduced by hundreds of dollars, after legislation changing how indexation charges on these debts are calculated passed through the parliament.

Indexation is applied to outstanding student debts every year in June and has previously been based on the inflation rate, or Consumer Price Index (CPI), which measures the percentage change in the price of a basket of goods.

The reforms, passed on Tuesday last week, mean student debts will now be indexed to the lower of either the CPI or the Wage Price Index (WPI), which measures the changes over time in wages.

This will see the average HECS debt of $27,000 cut by about $1,200, while a $50,000 HECS debt will be reduced by about $2,200.

Education Minister Jason Clare said the reforms will benefit all Australians with a student debt, rectify last year’s spike in indexation of 7.1 per cent and prevent indexation from outpacing wages into the future.

The changes will be backdated to June 1, 2023, lowering the indexation rate from 7.1 per cent to the WPI of 3.2 per cent.

This year’s indexation rate will also be reduced to 4 per cent, down from 4.7 per cent.

“This wipes out what happened last year and makes sure it never happens again,” Mr Clare said.

“Now the legislation has passed, the ATO will automatically apply these credits as soon as possible.”

Federal member for Corangamite Libby Coker said the reforms were cause for celebration.

“We know a quality education opens doors to new opportunities,” she said.

“For many young people, student debt can be a deterrent to pursuing a tertiary education, and that’s why we’re backing young Australians.

“We want to reduce the burden of debt, we want to reduce barriers to undertaking a qualification and we want to reduce cost-of-living pressures, particularly for young Australians who are just getting a start in life.”

Earlier this month, the Albanese government also pledged to cut a further 20 per cent of all student debt, raise the minimum repayment threshold for student loans and lower repayments by June 1 next year, should it win the next election.

This would see an average debt reduction of $5,500.

“In my electorate alone, this means reduced debt for 18,000 graduates,” Ms Coker said.

“The Albanese government will also lower repayment rates, because graduates shouldn’t have to pay off student debt until they’re earning a decent wage.”

The move would see the minimum student debt repayment threshold rise from $54,435 to $67,000, with repayments to be calculated on the income earned above that $67,000 threshold, rather than based on a graduate’s total annual income.