Australian Crypto Industry Intensifies Political Lobbying Amid Regulatory Debates

Australia’s crypto industry ramps up political lobbying as new regulations and tax reforms reshape the digital asset landscape.

Australia’s cryptocurrency sector is ramping up efforts to secure political support, aiming to influence regulatory reforms. As the Federal Treasury has initiated consultations on the implementation of the Crypto Asset Reporting Framework (CARF), and the Australian Securities and Investments Commission (ASIC) has updated its licensing guidelines for crypto-asset service providers, industry leaders are actively engaging with policymakers to advocate for a more accommodating regulatory environment.

In June 2024, the Australian government implemented a credit card ban for online gambling. This measure aimed to protect citizens from gambling with money they do not have but also included the ban of digital currencies (e.g. cryptocurrency) as payment methods. While this ban is effective for two years at all domestic sportsbooks licensed in Australia, there are still many offshore sportsbooks that safely allow you to use Bitcoin and other cryptocurrencies as a payment method. Companies opposed to the ban note that, as long as players understand the volatility of cryptocurrencies, the use of a credit card and crypto can’t be compared and shouldn’t fall under the same regulation.

On 21 November 2024, the Treasury released a consultation paper seeking public input on integrating the CARF into Australian tax law. Developed by the Organisation for Economic Co-operation and Development (OECD), the CARF is an international tax transparency framework designed to enable tax authorities to collect and share information on crypto-asset transactions.

This initiative aims to improve compliance with local tax laws and deter tax evasion by increasing the visibility of income derived from crypto assets. The consultation period concluded on 24 January 2025, with the government now reviewing feedback to finalize the framework’s implementation to enable the reporting and exchange of information by 2027.

Concurrently, ASIC has updated Information Sheet 225 (INFO 225) to provide clearer guidance on how the Corporations Act 2001 applies to crypto and digital assets. This update outlines the obligations of businesses involved with crypto-assets, including the requirement to hold an Australian Financial Services Licence (AFSL) for certain activities. ASIC’s guidance emphasizes that many digital asset-related products and services fall under the definition of financial products, necessitating compliance with existing financial services laws.

The implementation of the CARF and the reinforcement of licensing requirements aim to foster a secure and transparent environment for both consumers and service providers in the digital asset space. However, not all regulatory developments have been favorable for the crypto industry.

While consumer safety is meant to be at the core of all regulations, not everyone agrees with the proposed regulatory landscape. John O’Loghlen, head of Coinbase Australia, has expressed concerns over the Australian Securities and Investments Commission’s (ASIC) stringent regulatory approach towards crypto products. He cautions that overly burdensome regulations could drive businesses away from Australia, advocating for “complementary” legislation to ease these constraints. O’Loghlen emphasizes the need for a balanced approach that fosters innovation while ensuring consumer protection.

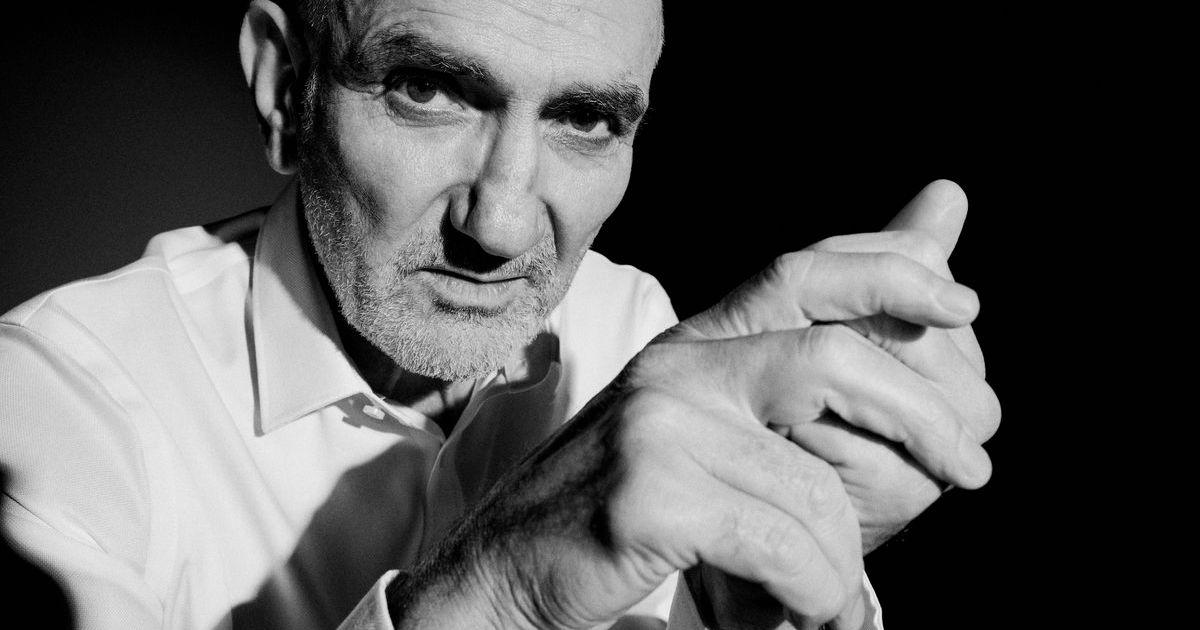

Fred Schebesta, co-founder of Finder.com.au and dubbed Australia’s “Crypto King,” has criticized the nation’s overregulation, which he believes stifles innovation and prosperity. He recounts his legal battle with ASIC over his Finder Earn product, which converted Australian dollars into cryptocurrency. Despite the lawsuit’s dismissal, the government appealed the case. Schebesta advocates for a balanced regulatory approach to foster industry growth, warning that Australia’s current lack of progressive policies may cause the country to lag behind in the crypto space.

The upcoming elections may see political parties aligning with the crypto industry, mirroring scenarios in other countries where substantial support was directed towards pro-crypto candidates.

//This content is provided by a third party