Bendigo Bank ups the ante in fraud, scam prevention

Fiscal fortress: Bendigo Bank prevented $47 million in potential fraud and scam payments between 1 July 2024 and 30 June this year, a 36 per cent improvement on the previous 12 months.

BENDIGO Bank has reported that it prevented forty-seven million dollars in potential fraud and scam payments between 1 July 2024 and 30 June this year, a thirty-six per cent reduction compared to the previous twelve months.

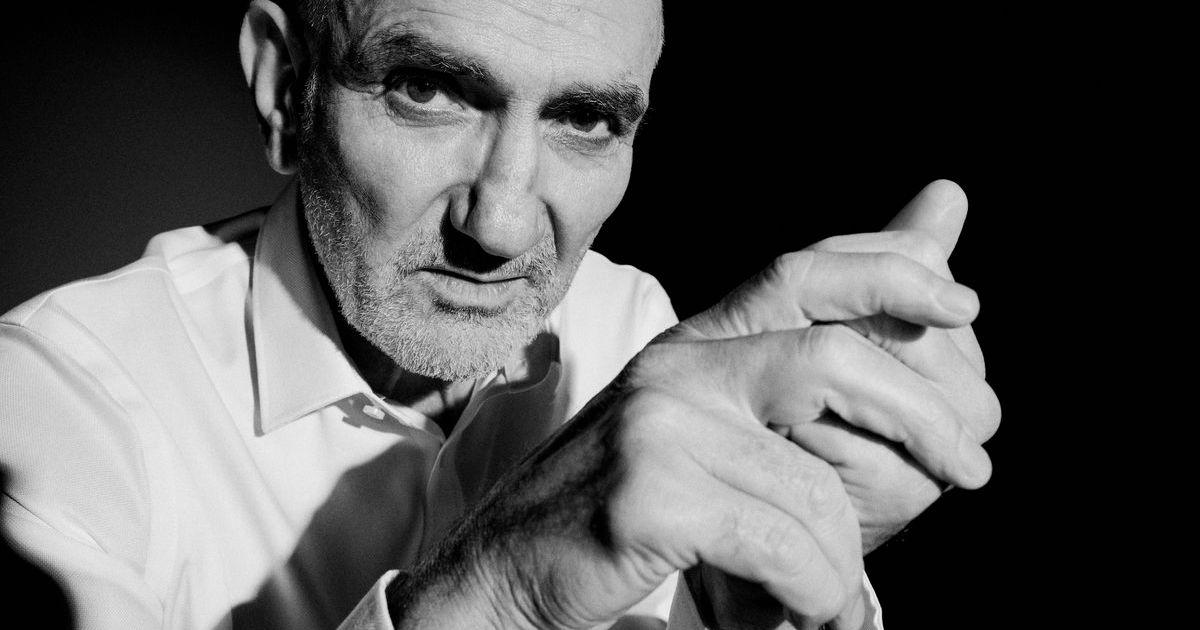

Jason Gordon, the bank’s head of customer and threat protection, said the result demonstrates the positive impact of the organisation’s investment in robust scam prevention technology and its commitment to protecting customers.

“The bank’s scam detection and response systems and the many safeguards stopping cyber-crime are working hand-in-hand with extensive customer education to prevent the loss of potentially life-changing amounts of money to scammers,” he said.

“With the help of our customers, the instance and success of scams can be reduced even further.”

The bank partners with industry and law enforcement bodies and analyses its customers’ behaviours, ensuring criminals employing scamming techniques are meeting their match against its people and technology.

Bendigo Bank also offers face-to-face education to help customers and the community safely navigate digital banking.

The 30-minute classes for customers and local community groups highlight the benefits and importance of becoming digitally connected, staying safe and recognising and preventing scams and fraud.

Signs of a scam include unexpected pop-up messages urging immediate action, requests to download and install unknown software, unsolicited calls from individuals claiming to be from reputable organisations, and unusual activity on your computer/device.

In 2024, combined scam losses reported by banks and government agencies in Australia amounted to $2.03 billion, compared to over $3.1 billion in 2022.