Delayed gratification for borrowers as RBA cuts again

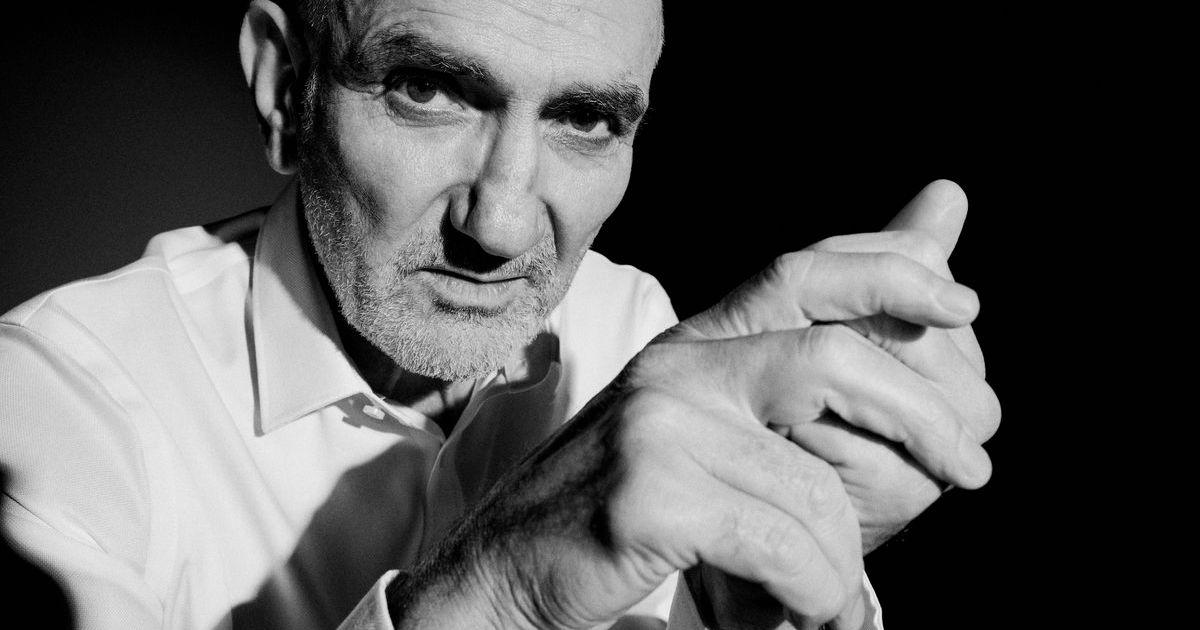

RBA Governor Michele Bullock said the latest move was designed to support economic activity while maintaining price stability. Photo: AAP

Borrowers have received welcome relief from the Reserve Bank of Australia, which has delivered a widely expected interest rate cut.

The central bank opted not to shock markets for a second time in two months on Tuesday.

Its decision to cut the cash rate by 25 basis points to 3.6 per cent – the third reduction in six months – will save borrowers with a $600,000 mortgage almost $90 a month in repayments and a cumulative $272 per month since cuts began in February.

The move brings the cash rate to its lowest level since May 2023, with the average variable mortgage rate expected to fall to 5.5 per cent.

But for many borrowers, the financial boost is behind schedule.

Most economists had expected the RBA to deliver further rate relief in its July meeting.

In a shock 6-3 decision, the board kept rates on hold, citing a need to wait for more inflation data to ensure price growth was coming down sustainably to target.

A benign consumer price index in late July and weaker jobs figures gave the bank the green light to deliver the cut that most saw as a matter of when, not if.

With money markets predicting more cuts coming down the pike, rising buyer confidence and borrowing capacity was set to support housing demand and price growth, REA senior economist Eleanor Creagh said.

According to Domain, the cut will lift borrowing power for households earning $50,000 a year by $4000 annually, while double-income households on $400,000 will be able to lift their loan limit by an extra $49,000.

“With more money chasing too few homes, prices are set to rise again,” said Domain chief economist Nicola Powell, who predicts house prices to climb six per cent and units to lift five per cent by mid-2026.

Traders will be glued to governor Michele Bullock’s post-meeting press conference for any signs of where the bank will move next.

Ahead of the decision, the market was pricing in another one-and-a-half cuts by Christmas.

All nine board members voted in favour of a cut.