2025’s property market

WITH GARETH KENT, DIRECTOR PRESTON ROWE PATERSON

Welcome to 2025. If you’re like me and keep putting 2024 on every date, you get a leave pass for another 30 days to get used to this new phenomenon.

Over the Christmas break, traditionally property markets go on hold. The exception is our coastal markets, which usually show strong growth following the influx of holidaymakers in these areas. Spare a thought for the poor coastal real estate agent who forgoes family catchups and Christmas dinner for house opens and contract exchanges.

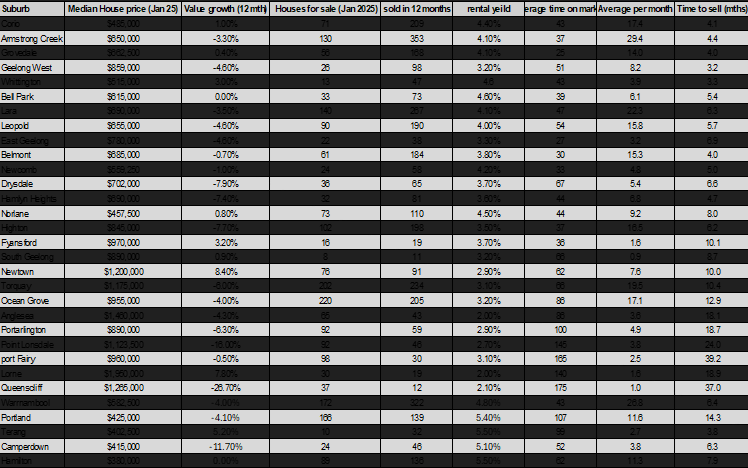

However, this year, despite the increase in population, the market remains relatively unaffected with people seemingly not thinking about that coastal change. The highest sale we have seen this season has been an Ocean Grove lifestyle property on 2,500sqm for $2.2 million. Ocean Grove, with more than 220 properties on the market in December, transacted only 17, and its average days on the market ballooning out to 86 days.

Portarlington has seen its average days on the market increase to 100, although, with 92 properties on the market, the average median price has remained constant at $890,000, suggesting vendors can wait for the result they need. Point Lonsdale has seen a downward shift in median house price by $46,000 over Christmas, with a median house price of $1,123,500. Queenscliff, Anglesea and Port Fairy recorded the most significant decrease in median house prices over the past month; in contrast to previous years when these coastal markets traditionally show strong growth.

This property downturn now looks significantly different to the Global Financial Crisis (GFC), where a volatile share market predetermined a short-lived property crash, from which a housing price recovery quickly manifested. The housing market is now far more linked to the cash rate than the share market, with many property owners locked into much higher mortgages and unable to sell those homes, suffering from a lack of cash flow.

The good thing here is that employment is still strong and given a weak GDP result and growth solely coming from the government sectors, the RBA has changed its dialogue to suggest they are moving toward an easing cycle, perhaps in early 2025. Economists’ opinions vary about how far this easing cycle will go, but suggestions of between 85 BPS and 110 BPS over a 10-month easing cycle are being suggested; this would land us at a cash rate of between 3.25 per cent and 3.5 per cent by early 2026.

Given the strong employment rate, this easing cycle should correspond to a return in confidence to property investment and a return to moderate property growth. Although the year might have started with a hangover, 2025 will recover; and by June, things will ideally have turned and this window of low demand and oversupply will be closed. Competition can then return to the markets.

Property markets aside, the next big thing for our region will be the Australia Day weekend from January 24 to January 26. This includes the Cadel Evans Road Great Ocean Road Race and the Festival of Sails. I’m looking forward to tackling the 130km ride, although not quite at Cadel’s pace. These fantastic events bring more people to our region, and provide another opportunity for local businesses, especially our suffering hospitality and property markets. This year, we will be able to celebrate with some fireworks, thanks to our new council for showing some common sense. Happy New Year, everyone.