Anti-investor sentiment set to deepen the rental crisis, say industry experts

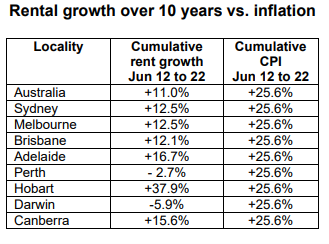

Research by property academic and former PIPA chair Peter Koulizos found rents increased by just 11 per cent nationally over the decade, but inflation rose by 25.6 per cent over the same period.

There has been much commentary on rental affordability, mostly from the point of view of tenants who feel first-hand the daily pain of trying to balance a budget in the face of rising rates.

Some industry experts are concerned that negative commentary from the media on the rental crisis is unfairly aimed at landlords and investors, painting them as the bad guys.

Property Investment Professionals of Australia (PIPA) pointed out not all investors are big players, and many landlords were mum and dad investors with one property.

PIPA research shows 71 per cent of investors own one property, and 90 per cent own just two, contrary to popular opinion about a plethora of mega-rich people who seemingly own dozens of properties.

Further industry research has found rents have grown at only half the rate of inflation for more than a decade – even after allowing for the past year’s rent increases and the recent inflation spikes.

Industry experts are concerned ongoing anti-investor sentiment is set to deepen the rental crisis.

PIPA and the Property Investors Council of Australia (PICA) have joined forces to highlight the financial reality for millions of property investors in the face of sharply rising ownership costs.

The research – using the Australian Bureau of Statistics Consumer Price Index from June 2012 to June 2022 – by renowned property academic Peter Koulizos, found rents increased by just 11 per cent nationally over the decade, but inflation rose by 25.6 per cent over the same period – a shortfall of nearly 15 per cent.

On an annual basis, rents increased by about one per cent per year, versus average inflation increasing at more than two per cent each year over the decade.

Mr Koulizos also analysed results at a capital city level, which found that rents didn’t keep up with inflation in every capital city apart from Hobart over the period.

“These results clearly show that rental growth has been below inflation for more than a decade, even with the recent spurt of rental price pressure,” Mr Koulizos said.

“As well as their cash flow taking a hit because of this income versus inflation imbalance, investors have also had to finance a huge variety of additional costs levied by all levels of government over the past decade.

“Governments deserted the supply of affordable rental properties years ago, expecting private investors to simply take over this responsibility, however more and more investors are deciding that it’s just not worth it.”

The analysis also found that the rents in Sydney are at the same level as 2016, with Melbourne posting rent at the same level as 2018.

PIPA chair Nicola McDougall said the volume of investors in the market was below historical averages for half of the research period as well, predominantly due to lending restrictions and yet rents remained well below inflation.

“The lending restrictions in 2017 unfairly targeted investors, with many unable to transact for a number of years,” Ms McDougall said.

“From that period of on, the supply of rental properties started to dwindle because investors simply couldn’t qualify for finance – but this research shows that rents have not kept up with inflation.

“Since the start of the pandemic, investors were initially asked to ‘take one for the team’ and supply free or low-cost housing to their tenants; are continually expected to pay higher costs for everything property-related – from council rates to stamp duty; and will soon be ‘double-taxed’ by the Queensland Government.”

Ms McDougall said it was little wonder there were reports of investors selling their properties in droves over the past two years because many have simply had enough.